On this page:

What is sole traders insurance?

Business insurance helps sole trader’s like you protect their growing businesses. Depending on the cover you choose, it could help you manage costs like third-party injuries, accidental property damage, and legal expenses.

Bad advice, slip and fall injuries, stolen equipment—the potential troubles for a sole trader never end.

Situations like these (and plenty of others) could create unplanned expenses for your business. If paying them out of pocket would put your plans in jeopardy, it may be time to consider business insurance.

Why might sole traders need insurance?

Business insurance isn’t mandatory in NZ for most businesses, but you may be required to have a policy to do things like:

Lease an office space.

Meet contractual obligations.

Pay legal costs if you face a liability claim.

Types of sole traders we cover

Each and every business is different, and that’s why BizCover offers business insurance options to cater to your individual needs.

We cover a broad range of sole trader occupations, including:

Can’t see your occupation listed above?

It doesn’t mean we don’t cover it. Start with a quote to find your occupation, compare cover options and buy online in minutes.

14000+ NZ

small business covered

Types of cover we offer sole traders

BizCover has insurance options for many types of sole trader’s.

Tailor your quote to your business, compare cover, and buy online in minutes.

Unsure what types of business insurance to get? We’ve got you! Here’s what other sole trader’s tend to choose:

Popular cover types for sole trader’s:

Sole trader’s could also consider:

Other Covers

Portable Equipment Insurance

Covers costs of repairing or replacing your portable tools, equipment, and stock against:

- Theft

- Fire

- Accidental or malicious damage

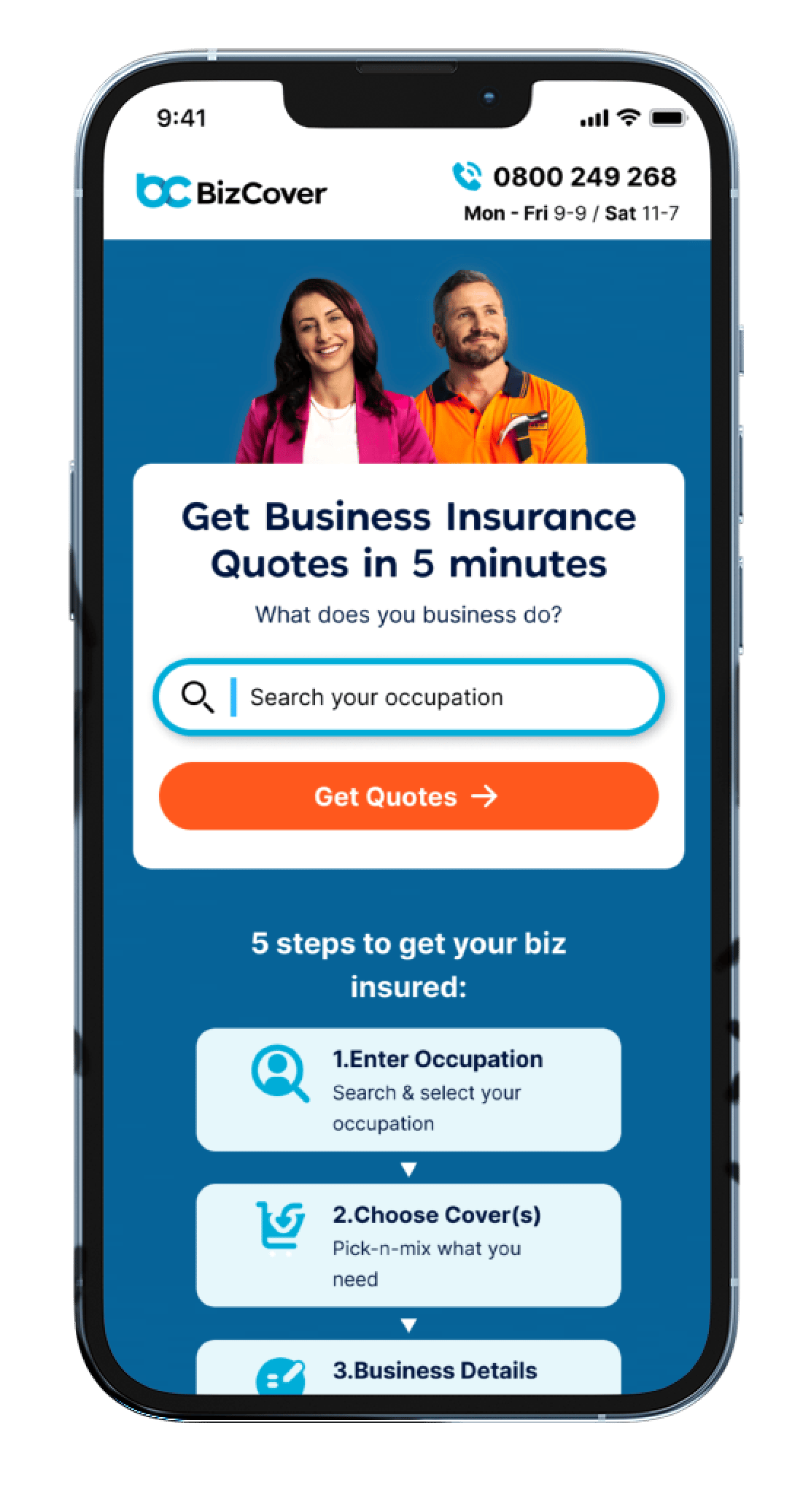

How it works – buying online

5 easy steps to get instant cover online today.

Select Profession

Pick Your Covers

Add Business Details

Compare Quotes

Get Covered Online

Search your

Occupation

Choose your

Cover(s)

Enter Business

Details

Compare

Quotes

Get Covered

Today

How it works – making a claim

We’ll assist you through the claims process & manage your claim directly with the insurer.

Let us know Fill out our claims form and provide info to support the claim

Receive extra support We will assist you with your claim

Claim results We will notify you of the claim outcome.

Let us know Fill out our claims form and provide info to spport the claim

Receive extra support We will assist you with your claim

Claims results We will notify you of the claim outcome

Our Insurers

We work with a selected group of trusted NZ insurers to offer you great cover.

The savings are real

See how much others have saved while purchasing policy through Bizcover

^ Savings made from January 2023 to July 2024. This information is provided as a guide only and may not reflect pricing for your particular business, as individual underwriting criteria will apply.

What sets BizCover apart?

We are not just a comparison and buy site.

Make Claims Online

We’ll manage the process on your behalf with the insurers.

Flexi Payment Options

Pay monthly or annually, cancel at any time.

One Stop Shop

Manage multiple cover types in one place.

Easy Renewals

Optional automatic renewal to stay protected.