On this page:

What is Cyber Liability Insurance?

Cyber Liability insurance is a type of business insurance that protects your business against the legal costs and expenses related to cybercrime incidents.

Cyber criminals are crafty. All they need is an internet connection to hijack your website, steal sensitive data, or send a dodgy invoice. Recovering from a cyberattack can be expensive – and that’s before potential legal costs and fixing the damage to your reputation.

Don’t let a hack turn into a headache. Consider protecting your business with Cyber Liability insurance.

What does Cyber Insurance cover?

Breaches and Extortion

The theft or loss of client information and ransomware demands.

Forensic Investigation

Analysing the cause and/or scope of a breach.

Data Recovery

The costs of recovering data or restoring systems from a backup.

Business Interruption

Loss of income and increased costs of operating due to a cyber incident.

Crisis Management

Hiring PR assistance to minimise damage to your reputation resulting from a cyber event.

Legal and Defence

The legal and defence costs associated with a claim.

- Damage to computer hardware.

- Failure or outage of power, utilities, satellites or telecommunication services.

- Intentional acts.

- Upgrading of an application, system or network.

- Known claims and circumstances.

Why you might need Cyber insurance?

Business Insurance isn’t mandatory in NZ for most business, but you may be required to have a Cyber policy to do thinks like:

Investigate and recover lost data.

Manage business interruptions.

Pay legal costs if you face a claim.

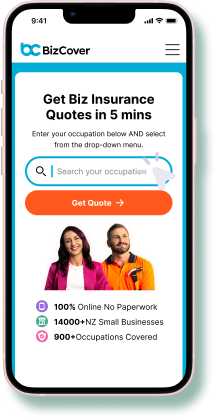

Get your Cyber cover sorted quicker than calling IT tech support.

Get your Public Liability insurance sorted quicker than a smoko break.

The costs are real, get that new policy feel

Cyber Liability

$142/mo*

Expected average cost

How is the cost of insurance calculated?

Risks of the industry

Cover level amount

Annual turnover

Number of employees

Claims history

*Customer Average Monthly Payment Report is based on is based on 1 July 2023 to 30 June 2024 and presented as a guide only. It may not reflect pricing for your particular business, as individual criteria will apply.

Click here to check industry wise average prices

Get cover that works with the risks of your business

You can select from 5 different levels of cover.

This is the most you will be paid out if you need to make a claim. Choosing different cover levels may impact the cost of your policy.

Flexible Cover

Pick from 5 levels of Cyber Liability cover

Unsure how much to choose? Think about:

Potential risk of a system outage

Cover required by contracts

Do you have recovery procedures

Do you run minimum weekly backups

Your contract value

Worst case scenario claim size

Underinsurance

We know it’s tempting to select a lower level of cover to reduce premiums, but this can leave businesses shocked and insufficiently covered when making a claim.

Ways underinsurance catches business owners out:

Inflation

With inflation, the cost of living and doing business increases. Remember to cover you, your tools and assets for the rising costs of replacing or covering them, not what you paid for them – you may be surprised at the difference.

Not covering the full cost of your risks

If you select cover levels for less than the value you may be found liable – left out of pocket when it comes to claims time. It’s important to review your risks and determine how much you will need to cover any claim that may come your way.

Cyber Liability

$142/mo*

Expected average cost

How is the cost of insurance calculated?

Risks of the industry

Cover level amount

Annual turnover

Number of employees

Claims history

*Customer Average Monthly Payment Report is based on FY24 and presented as a guide only. It may not reflect pricing for your particular business, as individual criteria will apply. This information is general only and does not take into account your objectives, financial situation or needs. It should not be relied upon as advice. As with any insurance, cover will be subject to the terms, conditions and exclusions contained in the policy wording.

Click here to check industry wise average prices

Get cover that works with the risks of your business

You can select from 5 different levels of cover.

This is the most you will be paid out if you need to make a claim. Choosing different cover levels may impact the cost of your policy.

Flexible Cover

Pick from 5 levels of Cyber Liability cover

Unsure how much to choose? Think about:

Statutory professional requirements

Cover required by contracts

Number of employees being covered

Your contract value

Worst case scenario claim size

Underinsurance

We know it’s tempting to select a lower level of cover to reduce premiums, but this can leave businesses shocked and insufficiently covered when making a claim.

Ways underinsurance catches business owners out:

Inflation

With inflation, the cost of living and doing business increases. Remember to cover you, your tools and assets for the rising costs of replacing or covering them, not what you paid for them – you may be surprised at the difference.

Not covering the full cost of your risks

If you select cover levels for less than the value you may be found liable – left out of pocket when it comes to claims time. It’s important to review your risks and determine how much you will need to cover any claim that may come your way.

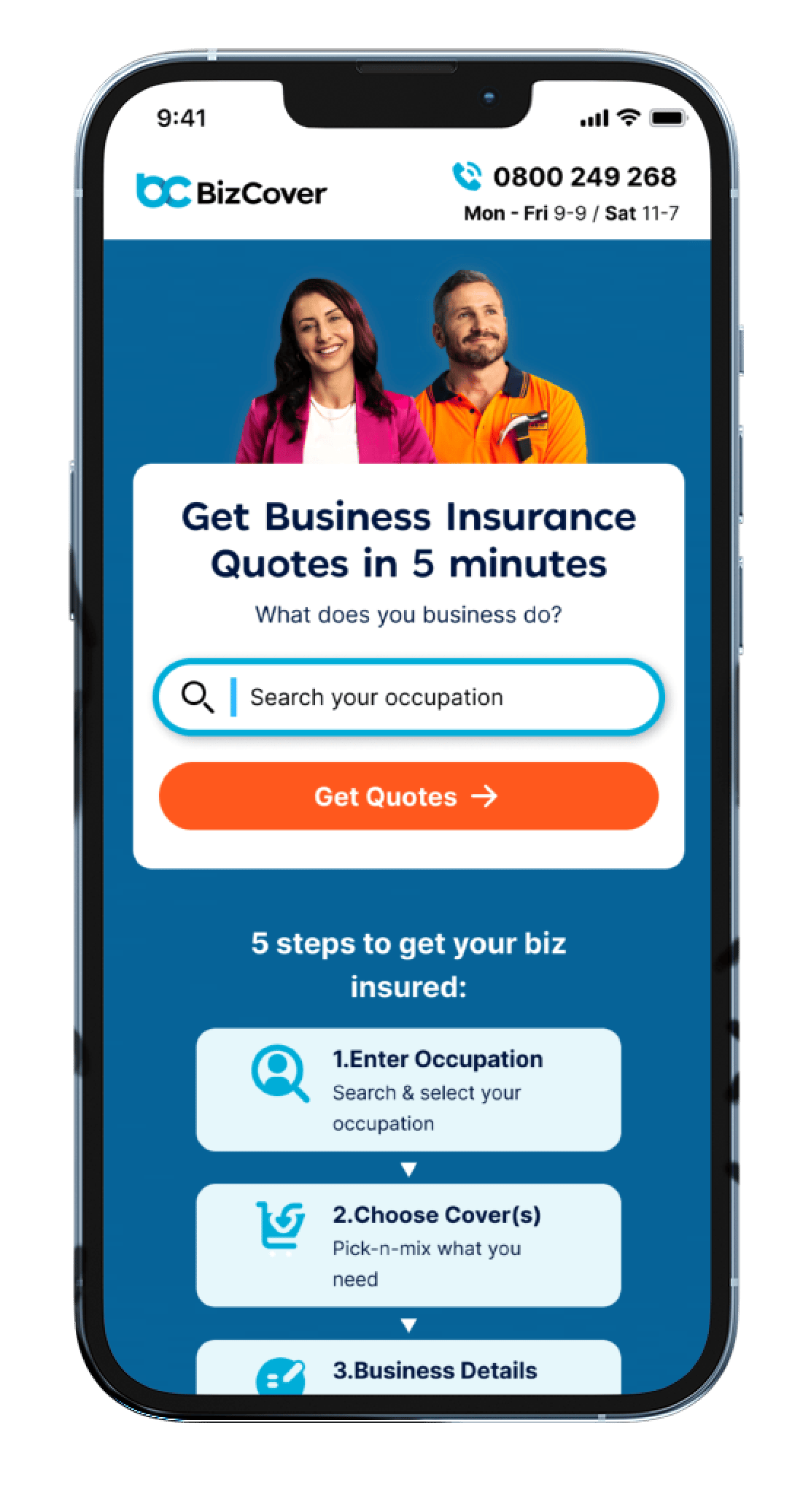

How it works – buying online

5 easy steps to get instant cover online today.

Select Profession

Pick Your Covers

Add Business Details

Compare Quotes

Get Covered Online

Search your

Occupation

Choose your

Cover(s)

Enter Business

Details

Compare

Quotes

Get Covered

Today

How it works – making a claim

We’ll assist you through the claims process & manage your claim directly with the insurer.

Let us know Fill out our claims form and provide info to support the claim

Receive extra support We will assist you with your claim

Claim results We will notify you of the claim outcome.

Let us know Fill out our claims form and provide info to spport the claim

Receive extra support We will assist you with your claim

Claims results We will notify you of the claim outcome

Our Insurers

We work with a selected group of trusted NZ insurers to offer you great cover.

The savings are real

See how much others have saved while purchasing policy through Bizcover

^ Savings made from January 2023 to July 2024. This information is provided as a guide only and may not reflect pricing for your particular business, as individual underwriting criteria will apply.

14000+ NZ

small business covered

What sets BizCover apart?

We are not just a comparison and buy site.

Make Claims Online

We’ll manage the process on your behalf with the insurers.

Flexi Payment Options

Pay monthly or annually, cancel at any time.

One Stop Shop

Manage multiple cover types in one place.

Easy Renewals

Optional automatic renewal to stay protected.

Frequently asked questions

Confused about Cyber insurance? We have answered the most common questions we get here.

If you still have questions, you can reach one of our friendly business insurance experts click here

You might not sell goods or services online, but chances are you still use a computer to run your business. Using a local network and server to hold important electronic files and records, messaging customers and suppliers by email, doing online banking, or having a business website or social media accounts can all make you a target of cybercriminals.

Here are a few tips to help protect your business from cybercrimes:

- Learn how to spot common cyber threats and scams, like phishing emails and messages.

- Secure your systems by installing a firewall and anti-virus software. This includes computers, tablets, mobile phones and point of sale devices (if possible).

- Install security updates as promptly as possible.

- Regularly back up data.

Create an incident response plan, so you know exactly what to do and who to call in the event of a cyberattack.

Yes. More than half of businesses in New Zealand experienced a cyber incident in 20221, and though attacks on large corporations make the news, small businesses may be more at risk. Think about it—you probably don’t have the time, knowledge or resources to protect yourself like the big guys can. Cybercriminals often prefer to target small businesses to make a quick buck, instead of wasting hours on a more well-protected company.

Cyber Liability insurance is designed to protect your business against the expense and legal costs arising from data breaches which may occur after being hacked, or from the theft or loss of client information. It can help you manage unplanned bills if hackers target your business (despite your best efforts).

1. HRD New Zealand, March 2023