On this page:

What is maintenance services insurance?

Business insurance helps maintenance service providers like you protect their growing businesses. Depending on the cover you choose, it could help you manage costs like property damage, stolen tools, and legal expenses.

Accidents can happen no matter how careful you are. Property damage, missing equipment, injuries—the potential troubles for a maintenance service business never end.

Situations like these could mean unplanned bills for your business. If paying them out of pocket would wipe your bank accounts clean, it may be time to consider business insurance.

Why maintenance services businesses night need insurance

You may be required to have business insurance to do things like:

Work with specific clients.

Work as a contractor or sub-contractor.

Lease commercial space.

Pay legal costs if you face a claim.

Types of maintenance services businesses we cover

BizCover has insurance options for a whole roster of businesses.

If you don’t see a match below, it doesn’t mean we can’t cover you.

Provides cleaning and light housekeeping services for homeowners.

Provides professional or specialty cleaning services for businesses and public places.

Gardeners

Plan, plant, cultivate and manage plants and gardens.

Landscapers

Designs, plans and maintains gardens and parks.

Lawn Mowing

Provides lawn mowing and maintenance for homeowners, businesses, or public spaces.

Fencing Contractors

Installs, repairs and maintains fences and gates.

Spa & Pool Cleaners

Removes debris, cleans filtration systems, and tests the water in private and public pools and spas.

Repair, maintenance, and improvement tasks around homes and businesses.

Window Cleaners

Cleans window glass and screens of dust, dirt and debris.

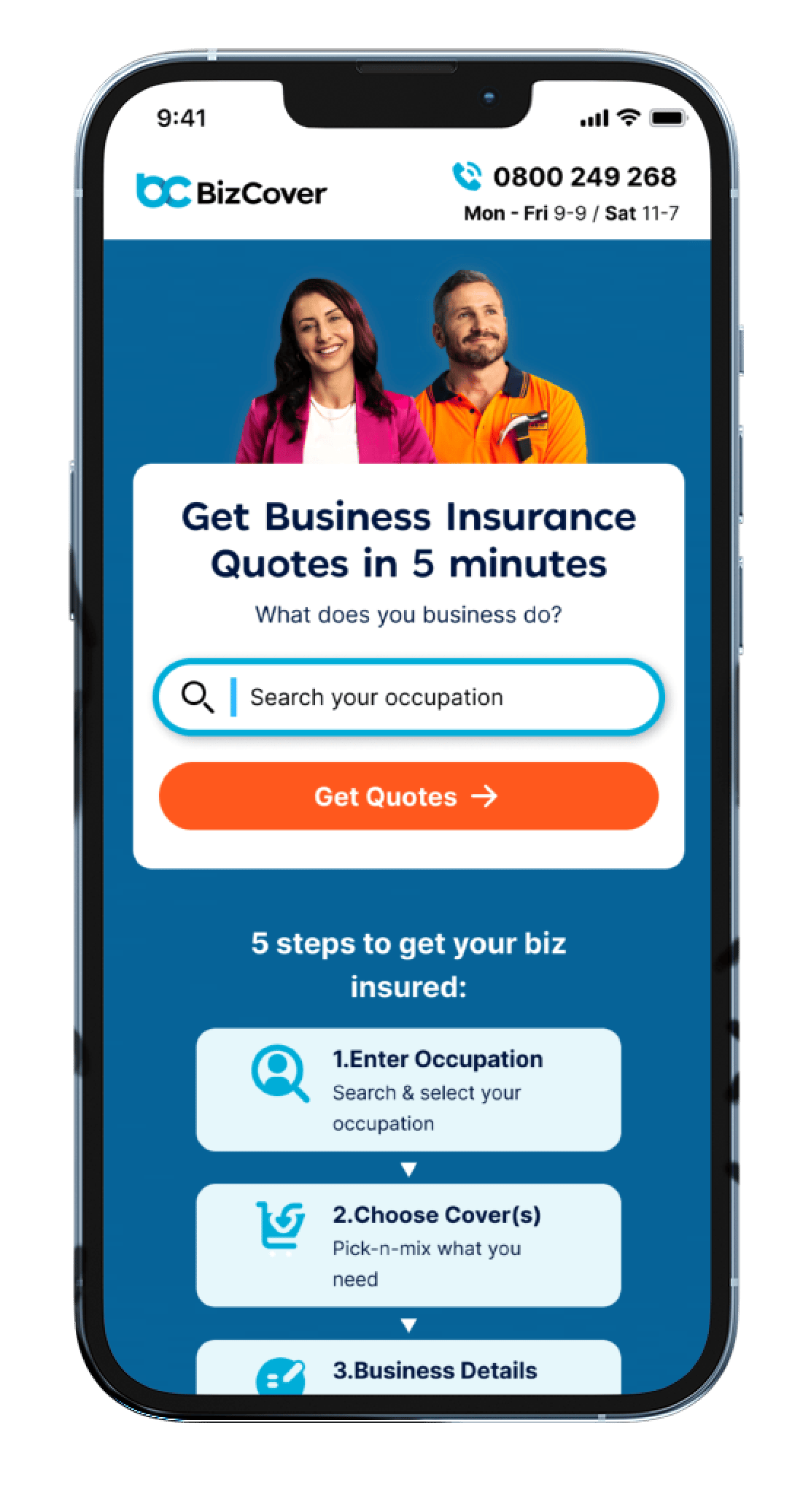

What does your business do?

Search your occupation, compare cover, and buy online in minutes.

Save time & money by buying online in minutes.

Types of cover we offer maintenance services business

Unsure what types of business insurance to get? We’ve got you! Here’s what other maintenance service providers tend to choose:

Popular cover types for maintenance services providers:

Maintenance service providers could also consider:

Other Covers

Statutory Liability Insurance

Covers you for an unintentional breach of key NZ business legislation, including:

- Legal and defence costs

- Fines and penalties

How much does maintenance services business insurance cost?

Your small business is unique. That means you might face different risks than other maintenance service providers and may pay a different price for your cover.

With BizCover, insurance can be tailored to fit the size, risks, and needs of your business.

Get cover that works with the risks of your business

Select different cover amounts for each policy listed below.

This is the most you will be paid out if you need to make a claim.

Unsure how much to choose? Think about:

Underinsurance

We know it’s tempting to select a lower level of cover to reduce premiums, but this can leave businesses shocked and insufficiently covered when making a claim.

Ways underinsurance catches business owners out:

Inflation

With inflation, the cost of living and doing business increases. Remember to cover you, your tools and assets for the rising costs of replacing or covering them, not what you paid for them – you may be surprised at the difference.

Not covering the full cost of your risks

If you select cover levels for less than the value you may be found liable – left out of pocket when it comes to claims time. It’s important to review your risks and determine how much you will need to cover any claim that may come your way.

Get cover that works with the risks of your business

You can select from 5 different levels of cover.

This is the most you will be paid out if you need to make a claim. Choosing different cover levels may impact the cost of your policy.

Unsure how much to choose? Think about:

Statutory professional requirements

Cover required by contracts

Number of employees being covered

Your contract value

Worst case scenario claim size

Underinsurance

We know it’s tempting to select a lower level of cover to reduce premiums, but this can leave businesses shocked and insufficiently covered when making a claim.

Ways underinsurance catches business owners out:

Inflation

With inflation, the cost of living and doing business increases. Remember to cover you, your tools and assets for the rising costs of replacing or covering them, not what you paid for them – you may be surprised at the difference.

Not covering the full cost of your risks

If you select cover levels for less than the value you may be found liable – left out of pocket when it comes to claims time. It’s important to review your risks and determine how much you will need to cover any claim that may come your way.

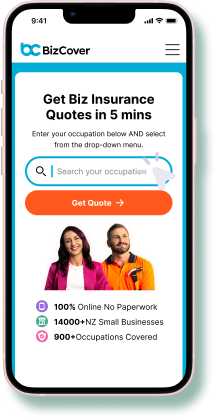

How it works – buying online

5 easy steps to get instant cover online today.

Select Profession

Pick Your Covers

Add Business Details

Compare Quotes

Get Covered Online

Search your

Occupation

Choose your

Cover(s)

Enter Business

Details

Compare

Quotes

Get Covered

Today

How it works – making a claim

We’ll assist you through the claims process & manage your claim directly with the insurer.

Let us know Fill out our claims form and provide info to support the claim

Receive extra support We will assist you with your claim

Claim results We will notify you of the claim outcome.

Let us know Fill out our claims form and provide info to spport the claim

Receive extra support We will assist you with your claim

Claims results We will notify you of the claim outcome

Our Insurers

We work with a selected group of trusted NZ insurers to offer you great cover.

The savings are real

See how much others have saved while purchasing policy through Bizcover

^ Savings made from January 2023 to July 2024. This information is provided as a guide only and may not reflect pricing for your particular business, as individual underwriting criteria will apply.

What sets BizCover apart?

We are not just a comparison and buy site.

Make Claims Online

We’ll manage the process on your behalf with the insurers.

Flexi Payment Options

Pay monthly or annually, cancel at any time.

One Stop Shop

Manage multiple cover types in one place.

Easy Renewals

Optional automatic renewal to stay protected.