On this page:

What is personal trainers insurance?

Business insurance helps personal trainers and fitness professionals like you protect their growing businesses. Depending on the cover you choose, it could help you manage costs like injuries, property damage, and legal expenses.

Client injuries, poor advice, stolen equipment—the potential troubles for personal trainers never end.

Situations like these (and plenty of others) could create unplanned expenses for your business. If the thought of paying them out of pocket raises your heartrate, it may be time to consider business insurance.

Why might personal trainers need insurance?

Business insurance isn’t mandatory in NZ for most businesses, but you may be required to have a policy to do things like:

Hold classes on council land.

Work as a gym contractor or sub-contractor.

Pay legal costs if you face a liability claim.

Types of personal trainers we cover

Each and every business is different, and that’s why BizCover offers business insurance options to cater to your individual needs.

We cover a broad range of personal trainers occupations, including:

Personal Trainers

Fitness Instructors

Yoga Teachers

Pilates Instructors

Gym Owners

Exercise Physiologist

Can’t see your occupation listed above?

It doesn’t mean we don’t cover it. Start with a quote to find your occupation, compare cover options and buy online in minutes.

Types of cover we offer personal trainers

BizCover has insurance options for personal trainers, fitness professionals and many more.

Tailor your quote to your business, compare cover, and buy online in minutes.

Unsure what types of business insurance to get? We’ve got you! Here’s what other personal trainers tend to choose:

Popular cover types for personal trainers:

Personal trainers could also consider:

Other Covers

Portable Equipment insurance

Covers costs of repairing or replacing your portable tools, equipment, and stock against:

- Theft

- Fire

- Accidental or malicious damage

14000+ NZ

small business covered

How much does a personal trainer’s insurance cost?

Your small business is unique. That means you might face different risks than the personal trainer down the street and may pay a different price for your cover.

With BizCover, insurance can be tailored to fit the size, risks, and needs of your business.

The prices are real, get that new policy feel

Combined Public Liability/ Professional Indemnity

$12/mo*

Expected average cost

Statutory Liability

$83/mo*

Expected average cost

How is the cost of insurance calculated?

Risks of the industry

Cover level amount

Annual turnover

Number of employees

Claims history

*Customer Average Monthly Payment Report is based on 1 July 2023 to 30 June 2024 and presented as a guide only. It may not reflect pricing for your particular business, as individual criteria will apply. This information is general only and does not take into account your objectives, financial situation or needs. It should not be relied upon as advice. As with any insurance, cover will be subject to the terms, conditions and exclusions contained in the policy wording.

Click here to check industry wise average prices

Get cover that works with the risks of your business

Select different cover amounts for each cover listed below.

This is the most you will be paid out if you need to make a claim.

Unsure how much to choose? Think about:

Statutory professional requirements

Cover required by contracts

Number of employees being covered

Your contract value

Worst case scenario claim size

Underinsurance

We know it’s tempting to select a lower level of cover to reduce premiums, but this can leave businesses shocked and insufficiently covered when making a claim.

Ways underinsurance catches business owners out:

Inflation

With inflation, the cost of living and doing business increases. Remember to cover you, your tools and assets for the rising costs of replacing or covering them, not what you paid for them – you may be surprised at the difference.

Not covering the full cost of your risks

If you select cover levels for less than the value you may be found liable – left out of pocket when it comes to claims time. It’s important to review your risks and determine how much you will need to cover any claim that may come your way.

Combined Public Liability/ Professional Indemnity

$12/mo*

Expected average cost

Statutory Liability

$17/mo*

Expected average cost

Factors influencing cost

Your Industry

Required Coverage

Your Turnover

Number of Emplyees

Claims History

Click here to check industry wise average prices

Get cover that works with the risks of your business

You can select from 5 different levels of cover.

This is the most you will be paid out if you need to make a claim. Choosing different cover levels may impact the cost of your policy.

Unsure how much to choose? Think about:

Statutory professional requirements

Cover required by contracts

Number of employees being covered

Your contract value

Worst case scenario claim size

Underinsurance

We know it’s tempting to select a lower level of cover to reduce premiums, but this can leave businesses shocked and insufficiently covered when making a claim.

Ways underinsurance catches business owners out:

Inflation

With inflation, the cost of living and doing business increases. Remember to cover you, your tools and assets for the rising costs of replacing or covering them, not what you paid for them – you may be surprised at the difference.

Not covering the full cost of your risks

If you select cover levels for less than the value you may be found liable – left out of pocket when it comes to claims time. It’s important to review your risks and determine how much you will need to cover any claim that may come your way.

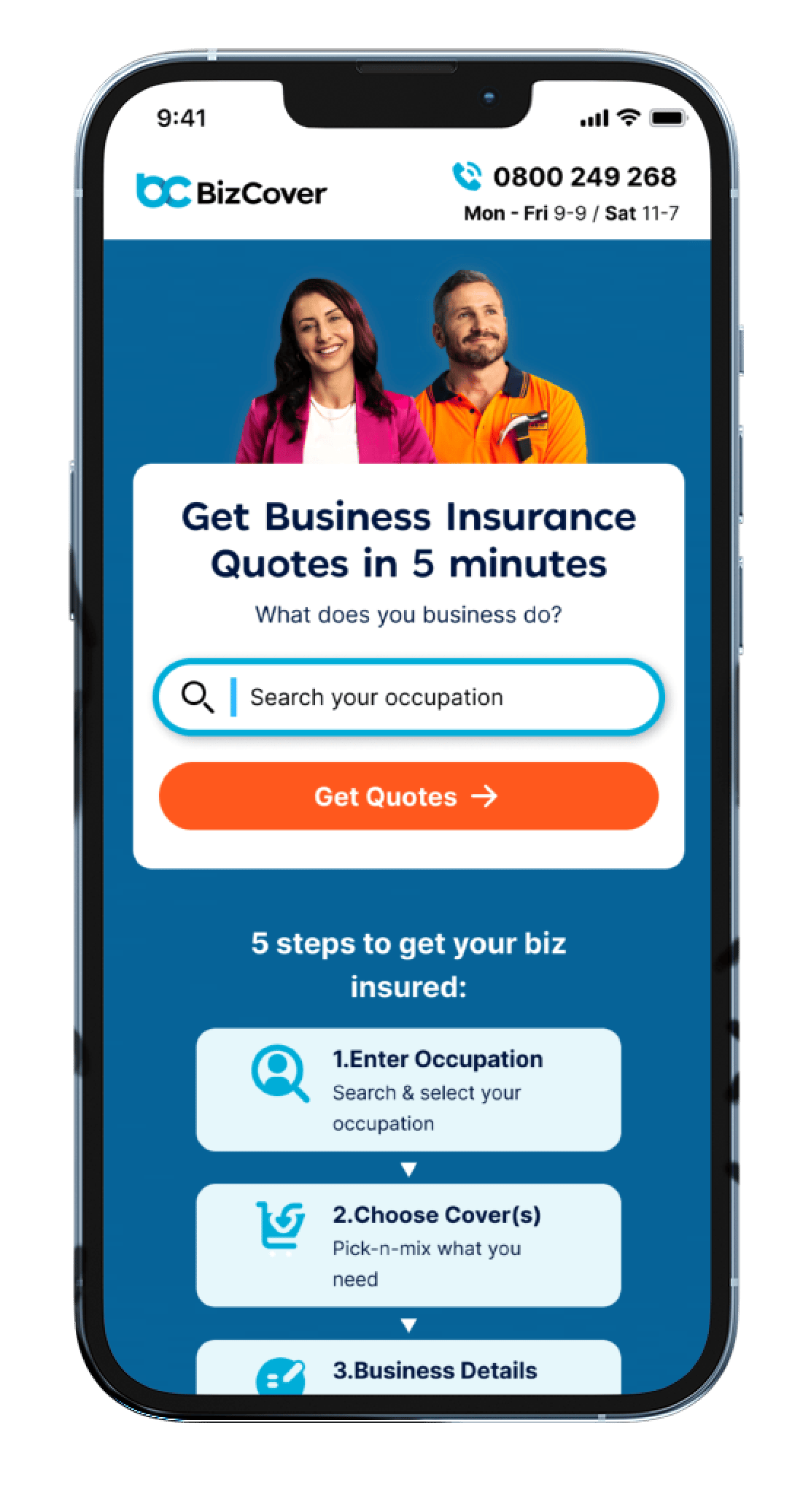

How it works – buying online

5 easy steps to get instant cover online today.

Select Profession

Pick Your Covers

Add Business Details

Compare Quotes

Get Covered Online

Search your

Occupation

Choose your

Cover(s)

Enter Business

Details

Compare

Quotes

Get Covered

Today

How it works – making a claim

We’ll assist you through the claims process & manage your claim directly with the insurer.

Let us know Fill out our claims form and provide info to support the claim

Receive extra support We will assist you with your claim

Claim results We will notify you of the claim outcome.

Let us know Fill out our claims form and provide info to spport the claim

Receive extra support We will assist you with your claim

Claims results We will notify you of the claim outcome

Our Insurers

We work with a selected group of trusted NZ insurers to offer you great cover.

The savings are real

See how much others have saved while purchasing policy through Bizcover

^ Savings made from January 2023 to July 2024. This information is provided as a guide only and may not reflect pricing for your particular business, as individual underwriting criteria will apply.

What sets BizCover apart?

We are not just a comparison and buy site.

Make Claims Online

We’ll manage the process on your behalf with the insurers.

Flexi Payment Options

Pay monthly or annually, cancel at any time.

One Stop Shop

Manage multiple cover types in one place.

Easy Renewals

Optional automatic renewal to stay protected.

Frequently asked questions

Confused about insuring your personal trainers business? We have answered the most common questions we get here.

If you still have questions, you can reach one of our friendly business insurance experts—go here for our Contact Us details.

These are some of the ways business insurance could help your personal training business stay fighting fit:

- If you are renting space for your personal training business, you may be required to have Public Liability insurance in place as part of your rental agreement.

- When you are providing professional fitness advice to your clients, there is an element of responsibility if that advice were to cause a client to suffer an injury (when not covered by the ACC). Professional Indemnity insurance could help if the client alleges professional negligence and/or seeks compensation.

- Public Liability insurance may be a requirement to work as a contractor within gyms or other fitness facilities. It may also be required to hold sessions in public spaces and on council land.

- If you offer mobile personal training services, you may want to consider protecting your expensive equipment and sporting aids with Portable Equipment cover.

Don’t sweat the small stuff when it comes to making sure you have the right business insurance in place. Let the energetic team at BizCover do the crunches to find competitive quotes and get you covered in no time.