On this page:

What is Professional Indemnity insurance?

Professional Indemnity insurance is designed for professionals who provide advice or a professional service to their clients. If someone alleges that you’ve made a fault, overlooked a critical piece of information, misstated a fact, or misinterpreted instructions resulting in a financial loss, they may take legal action against you to recover those losses.

Don’t let an accident turn into a nightmare. Consider protecting your business with Professional Indemnity insurance.

What does Professional Indemnity insurance cover?

Negligent or misleading advice

If a client alleges negligence in the performance of your work resulting in financial loss.

Breach of duty

For confidentiality and other privacy issues.

Defamation, slander or libel

If someone claims your work damaged their reputation.

Intellectual property and copyright infringement

Including copyright infringement.

Lost or damaged documents

If you lose or damage your customers important documents.

Damages and claimant costs

The compensation and legal fees resulting from a claim against your business.

Legal and defence costs

The legal and defence costs associated with a claim.

Claims investigation

Legal expenses to investigate a claim made against your business.

Inquiry attendance

The cost of attending inquiries or hearings for a claim.

Reputation damage

To manage or repair damage to your public image.

- Intentional damage

- Fraud and dishonesty

- Known claims and circumstances

- Bodily injury / property damage

15000+ NZ

small business covered

Why do I need professional indemnity insurance?

If your business provides specialist advice or services, you are open to risk of negligence claims. Even if you aren’t in the wrong, legal fees can come at a huge cost.

It may be time to consider Professional Indemnity insurance if you:

Provide advice or services

Handle sensitive information

Work in an industry with practice requirements

Want to join certain industry associations or bodies

Get Professional Indemnity cover while you wait for a flat white.

Get your Public Liability insurance sorted quicker than a smoko break.

How much does Professional Indemnity insurance cost?

Professional Indemnity insurance costs $86 per month* on average for BizCover NZ customers. But every business is unique, the cost of a policy can vary based on your business size, risks, insurance requirements and other factors.

The costs are real, get that new policy feel

$86/mo*

Expected average cost

How is the cost of insurance calculated?

Risks of the business

Business size

Annual turnover

The person being covered

Claims history

*Customer Average Monthly Payment Report is based on 1 July 2023 to 30 June 2024 and presented as a guide only. It may not reflect pricing for your particular business, as individual criteria will apply.

Click here to check industry wise average prices

Get cover that works with the risks of your business

You can select from many different levels of Professional Indemnity cover.

This is the most you will be paid out if you need to make a claim. Choosing different cover levels may impact the cost of your policy.

Flexible Cover

Pick from 11 levels of Professional Indemnity cover

Unsure how much to choose? Think about:

Statutory professional requirements

Cover required by contracts

Number of employees being covered

Your contract value

Worst case scenario claim size

Underinsurance

We know it’s tempting to select a lower level of cover to reduce premiums, but this can leave businesses shocked and insufficiently covered when making a claim.

Ways underinsurance catches business owners out:

Inflation

With inflation, the cost of living and doing business increases. Remember to cover you, your tools and assets for the rising costs of replacing or covering them, not what you paid for them – you may be surprised at the difference.

Not covering the full cost of your risks

If you select cover levels for less than the value you may be found liable – left out of pocket when it comes to claims time. It’s important to review your risks and determine how much you will need to cover any claim that may come your way.

Professional Indemnity

$86/mo*

Expected average cost

How is the cost of insurance calculated?

Risks of the industry

Cover level amount

Annual turnover

Number of employees

Claims history

*Customer Average Monthly Payment Report is based on FY24 and presented as a guide only. It may not reflect pricing for your particular business, as individual criteria will apply. This information is general only and does not take into account your objectives, financial situation or needs. It should not be relied upon as advice. As with any insurance, cover will be subject to the terms, conditions and exclusions contained in the policy wording.

Click here to check industry wise average prices

Get cover that works with the risks of your business

You can select from 5 different levels of cover.

This is the most you will be paid out if you need to make a claim. Choosing different cover levels may impact the cost of your policy.

Flexible Cover

Pick from 11 levels of Professional Indemnity cover

Unsure how much to choose? Think about:

Statutory professional requirements

Cover required by contracts

Number of employees being covered

Your contract value

Worst case scenario claim size

Underinsurance

We know it’s tempting to select a lower level of cover to reduce premiums, but this can leave businesses shocked and insufficiently covered when making a claim.

Ways underinsurance catches business owners out:

Inflation

With inflation, the cost of living and doing business increases. Remember to cover you, your tools and assets for the rising costs of replacing or covering them, not what you paid for them – you may be surprised at the difference.

Not covering the full cost of your risks

If you select cover levels for less than the value you may be found liable – left out of pocket when it comes to claims time. It’s important to review your risks and determine how much you will need to cover any claim that may come your way.

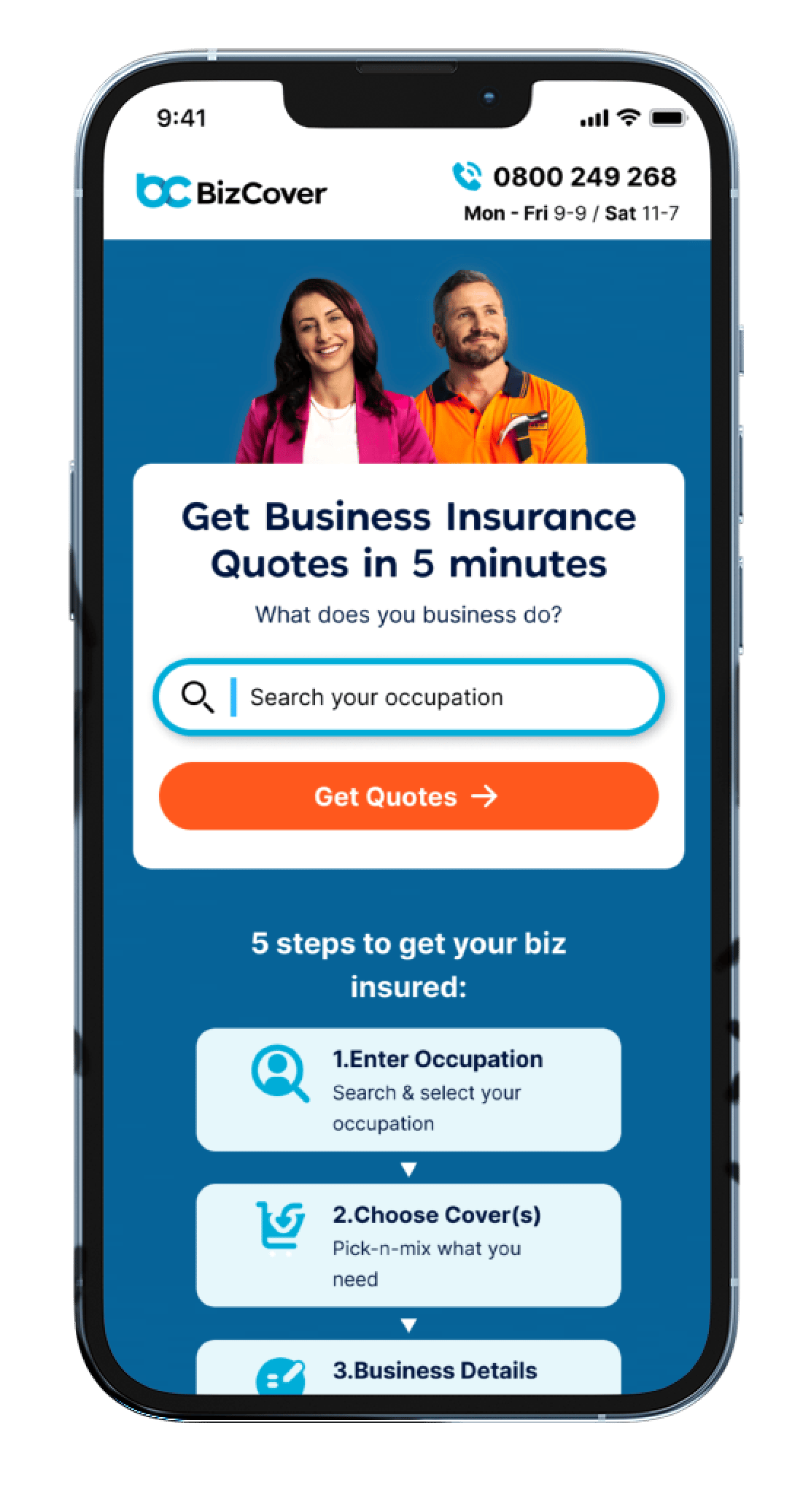

How it works – buying online

5 easy steps to get instant cover online today.

Select Profession

Pick Your Covers

Add Business Details

Compare Quotes

Get Covered Online

Search your

Occupation

Choose your

Cover(s)

Enter Business

Details

Compare

Quotes

Get Covered

Today

How it works – making a claim

We’ll assist you through the claims process & manage your claim directly with the insurer.

Let us know Fill out our claims form and provide info to support the claim

Receive extra support We will assist you with your claim

Claim results We will notify you of the claim outcome.

Let us know Fill out our claims form and provide info to spport the claim

Receive extra support We will assist you with your claim

Claims results We will notify you of the claim outcome

Our Insurers

We work with a selected group of trusted NZ insurers to offer you great cover.

The savings are real

See how much others have saved while purchasing policy through Bizcover

^ Savings made from January 2023 to July 2024. This information is provided as a guide only and may not reflect pricing for your particular business, as individual underwriting criteria will apply.

What sets BizCover apart?

We are not just a comparison and buy site.

Make Claims Online

We’ll manage the process on your behalf with the insurers.

Flexi Payment Options

Pay monthly or annually, cancel at any time.

One Stop Shop

Manage multiple cover types in one place.

Easy Renewals

Optional automatic renewal to stay protected.

Frequently asked questions

Confused about Professional Indemnity insurance? We have answered the most common questions we get here.

If you still have questions, you can reach one of our friendly business insurance experts – go here for our Contact Us details.

To cover your business with Professional Indemnity insurance you can compare quotes with BizCover in just 5 minutes. Answer a few questions about your business to get multiple quotes and buy online and get cover the same day.

If a business owner doesn’t have Professional Indemnity insurance, they may find themselves financially responsible if a client alleges a business made a fault in their work, gave them bad advice, defamed them, or breached intellectual property.

A business owner who doesn’t have Professional indemnity insurance may also find themselves unable to join certain industry associations or work on certain contracts in circumstances where it is a requirement.

While Professional Indemnity insurance is not a legal requirement for New Zealand business owners, it may still be a requirement in certain circumstances such as:

To work on some contracts

Joining some professional associations

To achieve certification

The amount of cover you need will depend on your risk appetite, and a range of factors specific to your business such as: statutory requirements for your profession, the amount of cover required in the contracts you work on, the number of people employed by the business, and the worst scenario claim size.

You can customise your cover amount to fit the needs of your business. BizCover offers 11 different cover limits between $250k and $10m.

If you are a business owner who operates from home, doing work which involves giving advice, Professional Indemnity insurance could help to protect you from associated legal cost of a client alleges your advice has negatively financially impacted them.

Yes, Professional Indemnity can cover sole traders and subcontractors in over 900 occupations.

Yes, in most cases Professional Indemnity insurance is a tax-deductible business operating expense in New Zealand.

If you need to make a claim on your Professional Indemnity insurance with BizCover you can start by visiting our claims page. You will need to fill out a claims form detailing what has occurred, you can also attach relevant documents such as:

- Any written demands or emails you may have received from the third party

- Any court proceedings

- Written contracts between you and the claimant.

Do not admit guilt, fault, or liability, or offer or negotiate to pay a claim without your insurer’s consent.

Professional Indemnity policies may include retroactive cover, which provides protection for claims arising from work completed before the start of the current policy period.

BizCover can offer policies with unlimited retroactive dates, meaning cover is provided for professional services performed at any time in the past, provided the claim is made while the policy is active. However, it should be noted that not every kind of previous service is covered. For example, if a sole trader previously owned a different business, then the policy would not cover that previous business if it was a separate entity. This is true even if the retroactive date is unlimited.

Run-off cover is a policy provision that can help protect you for a set period after you have retired, sold your business, or ceased trading. It is commonly offered with Professional Indemnity insurance policies.

Both Public Liability and Professional Indemnity insurance can protect your business from the result of a mistake or accident, but the types of faults and accidents they cover are different.

Public Liability insurance protects you and your business against the financial implications if you are found liable for loss or damage to other people’s property, or cause illness or injury that is not covered by the Accident Compensation Commission (ACC).

Professional Indemnity Professional Indemnity (PI) insurance is an important form of protection for businesses that provide specialist services or professional advice. It is designed to respond to claims against your business for losses as a result of actual or alleged negligent acts or omissions in the provision of your professional service or advice. PI Insurance will also assist with the legal costs associated with responding to or managing claims which are covered by the policy.

With a Professional Indemnity policy you may be required to notify your insurer when circumstances arise that could result in a claim . You have an obligation to inform your insurer as soon as practically possible once you become aware of any situation which could possibly result in a claim.

Failure to notify your insurer as soon as reasonably possible could lead to your claim being denied. So, even if you’re unsure whether it’s worthy of letting them know or not, it’s in your best interests to do so.

Business owners who buy Professional Indemnity insurance can also consider other popular types of cover such as Public Liability, Cyber Liability, or a Business Insurance Package.

Real-life customer reviews verified by Feefo