New Zealand small businesses saw a decrease in the number of cybercrime incidents over the first quarter this year after reports peaked at the end of 2021, according to a recent report.

But the country’s peak cyber-security advisory board urges business owners to not get too complacent as the threat to online security remains ever-present.

“Between January and March of this year, we received over 2,300 reports across the country and saw attackers using a range of new methods to try to get their hands on people’s finances and personal information,” says Rob Pope, Director of the national Computer Emergency Response Team (CERT NZ) in a media release.

“If we all put in the mahi and take one step at a time to improve our online security, this will go a long way to keeping ourselves better protected and help build a more cyber resilient Aotearoa New Zealand.”

What cybercriminals are targeting

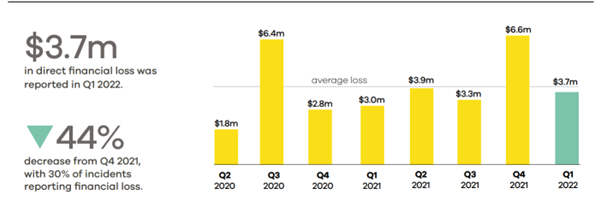

According to the report, New Zealanders collectively lost more than $3.7 million due to cybercrime in the first quarter of 2022, a significant decrease from the quarter before.

Phishing and credential harvesting remain the most common threat reported by far making up more than half of all cases.

“Phishing tries to mimic an authentic communication from a trusted source, usually through email or SMS,” says Pope. “Attackers use social engineering tactics, like urgency, fear and opportunity, to prompt the recipient to respond.”

Image taken from the CERT NZ Q1: Cyber Security Insights 2022

CERN NZ data found common phishing attempts included everything from the impersonation of government agencies, banks, and charities to fake relief reports for Ukraine and even phishing emails in te reo Māori.

Ransomware attacks have also increased over the quarter, with attackers increasingly targeting network attached storage (NAS) devices.

NAS devices are essentially large memory banks that store files, which is often used by businesses to give access to files from multiple devices.

Cybercriminals are accessing these databases, locking important files, and preventing the owners from accessing the information unless they pay a sum of money.

CERT NZ issued an advisory for small businesses during the first quarter of 2022 due to the prevalence of new reports.

How to safeguard your business

From backing up your data and using two factor identification to installing software updates as soon as possible, there are plenty of ways to prevent a cyber-attack effecting your small business.

In fact, CERT NZ has released a guide about tips to reduce the prevalence of a cyber-attack. But sometimes, these cyber-criminals can find a way in, and your business will be left to deal with the consequences.

Jordan Heersping, Acting Manager Incident Response CERT NZ says that while cyber insurance won’t stop a cyber-attack, it can help an organisation recover from an incident, which is an important aspect of cyber security.

“It’s important for businesses and organisations to have an incident response plan in the event of a cyber-attack,” says Heersping. “Part of this plan is understanding the assets in your business and whether the addition of cyber insurance is something that your business would require financially to recover from a cyber incident.”

Part of this plan can include having Cyber Liability insurance, which is a type of business insurance designed to protect your business against both the legal costs and other direct expenses related to cybercrime incidents.

“Recovering from a cyber-attack can be an expensive exercise for some businesses and organisations,” says heersping. “Costs can include things like incident response services, rebuilding business networks and systems and many other associated costs depending on the nature of the attack.”

While there is no magic bullet to beat cybercrime, there are clear ways to protect your small business and safeguard it from the consequences. Cyber insurance can be the cornerstone to build a plan on to ensure your small business remains cyber-safe for years to come.

*This information is a general guide only and does not take into account your objectives, financial situation or needs. As with any insurance, cover will be subject to the terms, conditions and exclusions contained in the policy wording. The information contained on this web page is general only and should not be relied upon as advice. © 2022 BizCover Pty Limited, all rights reserved. BizCover Limited is owned by BizCover Pty Ltd (ABN 68 127 707 975)